This is your very first post. Click the Edit link to modify or delete it, or start a new post. If you like, use this post to tell readers why you started this blog and what you plan to do with it.

This is the post excerpt.

This is your very first post. Click the Edit link to modify or delete it, or start a new post. If you like, use this post to tell readers why you started this blog and what you plan to do with it.

If you are in your 20 something and if retirement seems like a faraway dream, then there is a dramatic change needed. And no, this is not some exaggerated statement. This is very much possible. Are you wondering what the secret sauce is? Here, is the list.

So, by now if you still think that early retirement is a myth, then allow us to burst it. Go ahead, spend right, save more and follow your dreams as early as possible.

The capital of a company is divided into shares.

Each share forms a unit of ownership of a company and is offered for sale so as to raise capital for the company.

The holders of shares are called shareholders.

Shares are of two types- ordinary or equity shares and preference shares

What are ordinary/equity shares?

What are the features of equity shares?

Claim on income

Ordinary shareholders have a residual ownership claim.

Residual income is earnings available after paying expenses, interest charges, taxes, preference dividend, if any.

This residual income is either directly distributed to shareholders in the form of dividends or indirectly in the form of retained earnings which are reinvested in the business.

Retained earnings help in growth of the company, which is beneficial for the shareholders.

Claim on assets

On liquidation of the company, dues are paid to debt holders, preference shareholders and the remaining is paid to ordinary shareholders.

Right to control

Ordinary shareholders have the legal power to elect directors on board.

Board of directors approve major policies of the company and appoint managers to carry out day to day operations.

Thus, ordinary shareholders can control the management of company by choosing board of directors.

Voting rights

Ordinary shareholders have the right to vote on major decisions of the company eg. Change in memorandum of association, election of board of directors, etc.

An ordinary shareholder has votes equal to the number of shares held by him.

Limited liability

Liability of ordinary shareholders is limited to the amount of their investment in shares. In case of liquidation or any financial problem, ordinary shareholders are not liable to pay.

What are the advantages of equity shares?

Shareholders’ Point of View

Company’s Point of View:

What are the disadvantages of equity shares?

Shareholders’ Point of View:

Company’s Point of View:

For more information please visit http://www.fortunawealth.in

Debentures can be classified on the basis of:

The amount of registered debentures is payable only to those debenture holders whose name is mentioned in the register of the company.

If the debenture is transferred by the holder, it is necessary to inform the issuing company for updating its records.

Bearer debentures can be transferred by mere delivery to the new holder.

The interest and principal are paid to the person who produces the coupons attached to the debenture certificate.

The holders of secured debentures can recover the principal and unpaid interest amount out of the assets mortgaged by the company.

These debentures are further classified into– first and second mortgaged debentures.

At the time of liquidation of the company, first mortgaged debentures have the first charge over the assets of the company whereas second mortgaged debentures have secondary charge.

These debentures are redeemed either when the company chooses to pay back or at the time of liquidation.

The company may pay back to reduce its liability and notifies the debenture holder by issuing due notice for it.

Convertible debentures are further classified into:

For more information please visit http://www.fortunawealth.in

What is a debenture?

Debenture is one of the financial securities traded in capital markets.

It is defined as a long-term promissory note for raising loan capital where the company promises to pay interest and principal as stipulated.

Who can issue debentures?

Debenture can be issued by both corporations and governments.

An alternative form of debenture is a bond, mostly issued by public sector companies.

What are the features of debentures?

What are the advantages of debentures?

What are the disadvantages of debentures?

For more information please visit http://www.fortunawealth.in

Capital market facilitates buying and selling of financial securities such as shares, bonds or debentures.

Capital market channels savings and investment between suppliers of capital such as retail investors and institutional investors, and users of capital like businesses, government and individuals.

It has two mutually supporting and indivisible segments: the primary market and the secondary market.

Intermediaries such as investment bankers, merchant bankers, stock brokers, etc. play an important role in trading of securities in both the markets.

Primary market

In the primary market companies issue new securities to raise funds. Hence, this market is also known as the new issues market.

New or listed companies make public issue of shares which implies that the securities are sold to public including all individuals and institutional investors.

Public issue by new companies for the first time is called the initial public offering (IPO).

In this market, companies interact directly with investors.

Secondary market

The secondary market deals with second-hand securities ie. securities which have already been issued by companies that are listed in stock exchange.

These securities are listed and traded in the stock exchange. Hence this market is also known as the stock market.

In this market, investors interact with themselves.

Secondary market may also include over the counter (OTC) market and derivatives market.

The secondary market determines the price and risk of the securities issued.

This is helpful for both listed companies and investors to act in primary market.

The operations of primary and secondary markets in India are regulated by Security Exchange Board of India (SEBI).

For more information please visit http://www.fortunawealth.in

Mutual Fund schemes available are specific to investor needs such as financial position, risk tolerance and return expectations etc.

These can be classified by:

Structure

Open-ended funds are MFs which can issue and redeem their shares at any time.

Investors can conveniently buy and sell units at the existing NAV of the scheme.

There is no fixed maturity of these funds.

Key feature: liquidity of funds.

Close-ended schemes are MFs with a fixed no. of shares (or units) which are issued through a New Fund Offer (NFO).

The fund is open for subscription only during this specified period.

The fund is then structured, listed and traded on stock exchange. Investors can buy or sell the units on this stock exchange.

Some close-ended funds also give an option of selling back the units to the MF through periodic repurchase at NAV related prices.

They have stipulated maturity period (usually 3 to 15 years).

Key features: fixed no. of units, limited availability.

Interval schemes combine features of both open-ended and close-ended schemes.

The units may be traded on the stock exchange or may be open for sale or redemption during pre-determined intervals at NAV-related prices.

Key features: features of both open-ended and close-ended schemes.

Investment Objective

The aim of growth funds is to provide capital appreciation over the medium to long-term.

These schemes usually invest majority of their portfolio in equities and so have comparatively high risks.

Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

Key features: capital appreciation over the medium to long-term.

It can be further classified into following depending upon objective:

The aim of Income Funds is to provide regular and steady income to investors.

These funds generally invest in fixed income securities such as bonds, corporate debentures and Government securities and money-market instruments. So, the opportunities of capital appreciation get restricted.

These funds do not participate into markets. Hence, there is no market risk or volatility and are less risky compared to equity schemes.

Key features: regular and steady income to investors.

The aim of Balanced Funds is to provide both growth and regular income.

These schemes invest both in equities and fixed income instruments in the proportion indicated in their offer documents.

Balanced funds are ideal for investors looking for income as well as moderate growth.

Key features: capital appreciation and regular income to investors.

The aim of Money Market Funds is to provide easy liquidity, preservation of capital and moderate income.

These funds exclusively invest in safer short-term instruments such as Treasury Bills, Certificates of Deposits, Commercial Paper and inter-bank call money, Government Securities, etc.

Fluctuations in returns of these schemes are much less than other funds.

These are appropriate for investors who wish to invest for short periods.

Key features: easy liquidity, preservation of capital and moderate income.

These funds invest exclusively in Government Securities.

Fund of Funds invests in other MF schemes.

Such schemes can help investors reduce their chances of selecting a wrong MF.

It is an open-ended Exchange Traded Fund which provides return that is in line with the return on investment in physical gold.

These are open-ended income schemes which invest equally in floating rate debt instruments and fixed rate debt instruments.

Other Schemes

Investments in these funds are exempt from income tax at the time of investment upto Rs. 1,50,000 per annum under Section 80C.

ELSS have a lock in period of 3 years.

Index schemes replicate the portfolio of a particular index such as the BSE Sensitive index, S&P NSE 50 index (Nifty), etc.

Sectoral Funds are those which invest exclusively in a specified sector(s) such as FMCG, IT, Pharmaceuticals, Infrastructure, petroleum stocks, etc.

While these funds may give higher returns, they are more risky compared to diversified funds as their portfolio is restricted to the specific sectors.

A load fund is one that charges a percentage of NAV for exit ie.

A charge is payable each time one sells units in the fund.

This charge is used by the MF for marketing and distribution expenses.

As and when MF companies make profits, part of the money is distributed to the investors by way of dividends.

This is similar to the previous scheme.

However, the dividend declared is re-invested in the same fund on the same day’s NAV.

For more information please visit http://www.fortunawealth.in

What is a Mutual Fund (MF)?

A mutual fund is a trust that pools money of like-minded investors with similar investment objective.

These MF schemes are managed by respective Asset Management Companies (AMC).

The AMC hires a professional money manager, who buys and sells securities in line with the fund’s stated objective.

The pooled money is invested in a diversified portfolio of securities including equity shares, debentures, convertibles, bonds, money market instruments or other securities.

Each unit of any scheme represents the proportion of pool owned by the investor (unit holder).

How do I get returns on a MF?

Returns on a MF are earned in the form of:

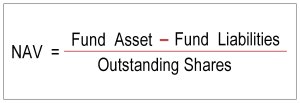

What is Net asset value (NAV)?

NAV is the appreciation or reduction in value of investments which is regularly declared by the fund.

NAV per unit is calculated as:

What are the benefits of MFs?

For more information please visit http://www.fortunawealth.in

Critical illness (CI) insurance is a long-term insurance policy to cover specific serious illnesses listed within a policy.

If diagnosed with a serious illness, the insurance company will provide single lump-sum payment.

The payment is made when you survive a certain period (typically a month) after confirmation of the diagnosis.

You can buy a CI cover either for yourself or jointly with your spouse.

What is covered?

The number of critical illnesses varies from insurer to insurer. Most insurance companies cover:

What is excluded?

What are the benefits of CI plan?

CI benefit irrespective of hospitalization

Hospitalization is not required because diagnosis is enough to get CI benefits.

On submitting medical documents confirming diagnosis, you will receive a single lump sum amount.

Financial support

You can spend the money to pay for cost of your treatment, recuperation expense, clear any debts, pay your rent or mortgage, pay for medical bills or to adapt your home to your particular needs.

Tax-free payout

The one time lump sum amount paid on diagnosis of a serious illness is tax-free.

Protection against untimely death

In case of an untimely death, your nominee will receive the lump sum payout. However, this amount is paid only when you survive the 30 day period after diagnosis of an illness.

What to consider before you buy a CI plan?

CI plan does not cover hospitalization costs. The lump sum paid is as per your policy amount.

So you will still require a health insurance plan to meet these expenses.

Also, the policy has well-defined terms and conditions for diagnosis of an illness.

For instance, you need to undergo specific tests, by specific physician to confirm diagnosis of the illness.

Payout is made only for the specific illness (as per the severity mentioned in the policy). There are many illnesses which are excluded.

Do consult your financial advisor to help you understand the policy details before buying a critical illness plan.

For more information please visit http://www.fortunawealth.in

While retirement may seem distant for many, retirement security is as important as any of your other financial goals.

Due to rising cost of living, inflation and increased life expectancy, financial planning is essential to live a happy and comfortable life after retirement.

Pension plans or retirement plans are one of the tools available to build a retirement corpus.

Pension plan provides regular fixed monthly pension at the end of the period for lifetime. Investment is made by paying premiums to build a corpus which is invested in various funds.

Insurance companies, Mutual fund companies and Government provide pension plans with unique benefits.

For instance, Insurance companies provide pension plans with the waiver of premium rider or partner care rider.

In the event of an unforeseen calamity like death, the future premiums will be waived off.

The Insurance company will pay the future premiums on your behalf. This will ensure that your nominee receives the same pension till the end of the period.

Do consult your financial advisor to choose the appropriate plan as per your requirements.

Types of pension plans:

Immediate Annuity

In immediate annuity, the pension begins immediately. You have to pay a lump sum amount and your pension will start instantly.

The pension you receive will be based on the lump sum you have invested.

Deferred Annuity

In deferred annuity, pension does not commence immediately. It is ‘deferred’ up to a time, which is decided upon by you.

This implies that you have to pay the premiums till the policy term, after which you will start receiving your pension.

Premiums can be paid as single premium or as regular premium.

With cover pension plan

‘With cover’ plan provides life coverage which implies that in case of death, a lump sum amount is paid to your family.

However, the cover amount is not very high as major part of the premium is invested to build the retirement corpus.

Deferred annuity plans are available with cover.

Without cover pension plan

‘Without cover’ implies that you do not get any life cover.

In case of death, your family will receive the accumulated corpus till the date of your death.

Immediate annuity plans are available without cover.

Annuity Certain

The annuity is paid for a specific period as chosen by you.

In case of death before this period, your beneficiary would receive the annuity.

Guaranteed Period Annuity

Annuity is paid for certain periods whether or not you survive that duration.

Life Annuity

In a life annuity plan pension is paid until death.

If you choose ‘with spouse’ option, then in case of death, the pension is paid to your spouse.

National Pension Scheme (NPS)

NPS has been introduced by the government. The amount you save in NPS will be invested in equity and debt.

You have the option of withdrawing 60% of the amount at retirement and the remaining 40% has to be used to purchase annuity.

The maturity amount is not tax free though.

For more information please visit http://www.fortunawealth.in